13 Apr 2016

Lethbridge Herald

Dean Bennett THE CANADIAN PRESS — EDMONTON

AUDITOR GENERAL RIPS FAILED SCHOOL CONSTRUCTION

Alberta’s auditor general says the former Progressive Conservative government’s grand plan for 100 new schools was built on empty promises, administrative chaos, and almost no money. Merwan Saher, in a report issued Tuesday, said Albertans during the era of former premiers Alison Redford and Jim Prentice were promised something that had little hope of succeeding.

“I believe the lessons for ministers are don’t create false public expectations,” Saher told reporters after filing his report to the legislature.

Saher was asked last fall by Rachel Notley’s NDP government to investigate school construction under the previous two premiers after it announced there would be lengthy delays in 101 Tory-announced school projects.

In the decade prior to 2011 the province was building on average 18 schools a year, Saher said.

All changed under Redford’s government when it promised 50 new schools in 2012, but also introduced organizational changes that sowed confusion between the Education and Infrastructure departments with no clear hierarchy of authority, the auditor general said.

“No one was responsible for overall results,” Saher wrote.

Bureaucrats couldn’t give ministers the correct information because no one had the full picture, he said.

As a result, he wrote, “ministers made public commitments and announced completion dates without evidence those dates were reasonably attainable.”

Redford resigned as premier in March 2014 in a scandal over lavish spending on herself and inner circle.

She was replaced by Prentice whose government announced another 55 new schools.

But Saher said the funding in the budget for the schools was unclear under Redford and all but non-existent under Prentice.

![]()

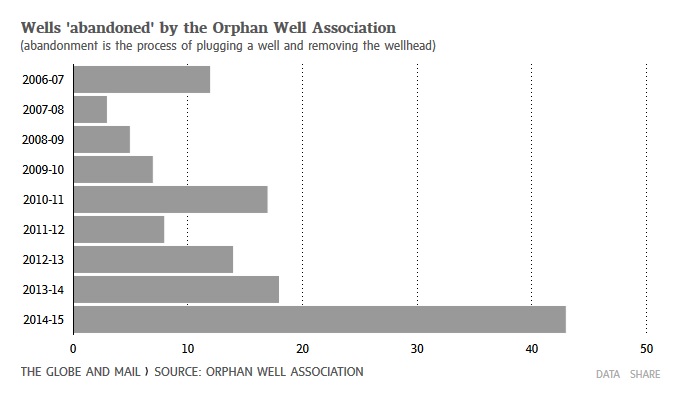

A pump jack on land south of Calgary, whose owner fears the well will soon be considered orphaned. Chris Bolin/Chris Bolin

A pump jack on land south of Calgary, whose owner fears the well will soon be considered orphaned. Chris Bolin/Chris Bolin Gale Tharle, a 4th-generation Alberta rancher, is photographed on his land an hour south of Calgary.

Gale Tharle, a 4th-generation Alberta rancher, is photographed on his land an hour south of Calgary.