Posted on May 5, 2022

By Cole Parkinson

Westwind Weekly News

The Action Surface Rights board has been busy with a variety of different work over the past several months. With no Annual General Meeting due to COVID last year, this year the group was able to host one in March and members were updated on what the board has been up to.

“The directors and executive of this association are landowners just like you and we’re going up against large corporations, high priced lawyers, high-priced experts that generally have a better understanding of things than we do,” explained Daryl Bennett, a director with ASR.

One job the group has been helping with is close to home as an industry business was looking to buy some wells on a Taber landowner’s property.

“We have a case here in Taber where an operator wanted to buy a bunch of wells on own of our owner’s lands and it probably wasn’t a good idea. They notified the landowner, he filed a statement of concern, and it was blocked. But, you as a landowner are now supposed to get the AER website every week and take a look at it to see if there is an application to transfer your wells to somebody else because they won’t notify you. We’re going ‘well, where do you find this on the AER website?’ It’s there, you then have to file a statement of concern, which is a form to block somebody from taking wells that are on your land,” said Bennett. “Your lease says they are supposed to notify you of assignment, but if the company is bankrupt it doesn’t make any difference. The AER is just transferring these to whoever and we’re worried they will transfer them to geothermal.”

“Because it is the AER and they are super-regulator, they’re allowed to do that. If you object or block them, there’s large penalties and fines in the act that can affect you,” added Bennett.

Bill 82, The Mineral Resource Development Act, was also brought forward to members. The bill received royal assent on Dec. 2, 2021, and the province states the bill “aligns the Alberta Energy Regulator’s (AER) authority over minerals with its authority over other energy resources and helps enhance the fiscal and regulatory environment for metallic and industrial mineral development, supporting the second key area in Renewing Alberta’s Mineral Strategy.”

“A provision of this act or the regulations and rules made under this act, or any declaration or order by the regulator, which is the AER, made under this act overrides any term or condition of any contract or other arrangement that conflicts with the provision of this act or the regulation rules,” added Bennett. “No terms or conditions of a contract or other arrangement that conflicts with a provision to what AER says is enforceable or gives rise to any cause of action by any party against any other party. That is your surface lease agreement. Anything the AER wants to do, they can override any of the terms in your surface lease agreement and that is where we have some big concerns.”

“We have raised them and it hasn’t been addressed.”

The next topic brought up was around the province’s Red Tape Reduction Act. While the province billed it as a positive for Albertans, the ASR see it as a negative for landowners. Bennett also touched on a Supreme Court decision that could affect landowners.

“That is something our local MLA was involved with and it’s probably one of the worst things they could have done to landowners,” confirmed Bennett. “Vavilov is a Supreme Court decision and it came up just a little while ago. If I get a Surface Rights Board decision and I don’t like it, I appeal to a court. A court used to look at it (and say) ‘there’s a standard of review. Was what they did reasonable?’ That’s the lower standard of review and the higher standard of review is correctness — did they follow the law? ‘If they didn’t follow the law, we’ll overturn it because they were wrong.’“

“In the Vavilov decision, the court said ‘look, if there is a lower court decision, we don’t owe that judge any difference — he’s either right or he’s wrong. When it gets to us, we say were you right or wrong? Why is some board that doesn’t know the law, why do we owe them more than a judge that does know the law?’” continued Bennett. “Right after the Vavilov decision, Bill 48 came in and said ‘in all dealings with the Surface Rights Board Land Property Rights Tribunal, the standard of review will now be reasonableness, not correctness of the Supreme Court setting. That is a big problem because if you stack the board with political lackeys, tell them to reduce compensation because the province is having to pay too much out to landowners.”

From ASR’s perspective, these recent rulings have been heavily favoured to industry and not landowners.

“In my opinion, the board and rules are moving away from landowner protections in favour of industry. They are allowing industry to take advantage of us more. These laws are being written to allow that to occur,” added Bennett.

Another thing brought forward for landowner awareness was around lower rates given to landowners.

“Lynx and Ember, when they came in they bought all of these wells, sent all of the landowners a letter saying we’re going to slash all of these rates and half of the landowners said ‘OK, as long as we get some money’ and signed. Now, when I show up to a hearing, that’s the new pattern, they are the comparable companies are bringing forward. If the landowner doesn’t accept it, they are fired off Section 27 applications saying ‘hey, the compensation is too high and we want you to have a hearing and we want you to slash the rates because they won’t accept us slashing the rates.’ And then they bring in their lawyers,” added Bennett. “What happened is, the law actually says the company can’t just do this whenever they want. On the fourth year anniversary of the surface lease, they are supposed to send you a note within 30 days saying ‘hey, we either want to change the rental ourselves or you have the right to have it changed.’ That is what the law says, but Lynx, they sent out notifications to all of the landowners saying ‘we’ve come to that time in history where it’s the fourth year anniversary and we have a right to have a review. We think it should stay the same.’ Eight months later, Lynx bought all of these wells and said ‘it’s way too high’ and sent all of these letters out. Now they’re saying ‘our new offer is 75 per cent less of what it was and if you don’t want to accept it, we’re going to the board, and then they apply to the board.”

The group has been helping whenever they can on different landowner court cases as well. One of the ways they help is by paying some legal fees, and Bennett said they will likely continue to do that.

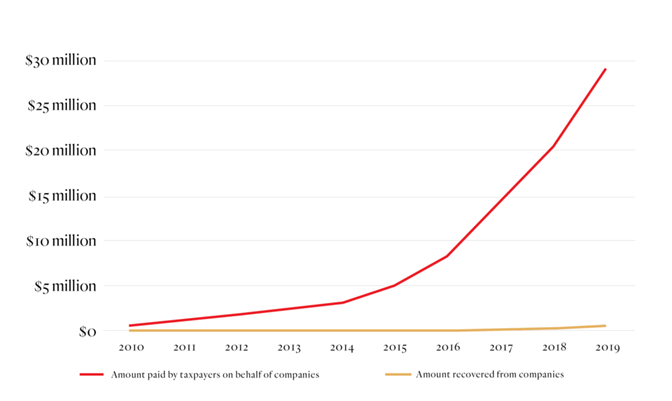

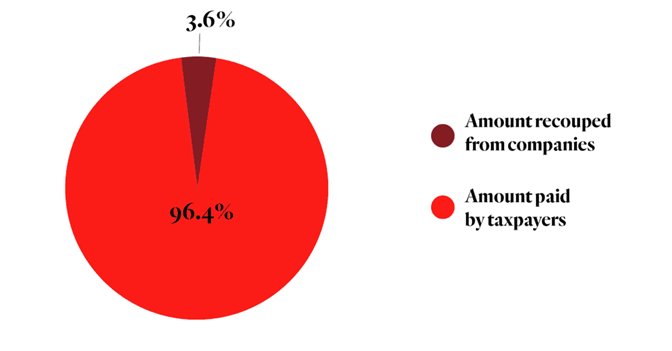

“In the last few years, what this group has done is on landmark cases, we’ve helped pay some of the legal bills. Some of it we get back, see times if we lose, we don’t get it back. In a lot of cases when a landowner goes to court, we’re talking $50,000, $60,000 and if you lose, you can’t afford to pay that,” he said. “We try to take test cases that will affect all landowners in the province and help offset the legal bills of some of the landowners. The board has also started to say they have some obligation to the taxpayer and that’s where we don’t want to pay the full amount because it’s coming out of the taxpayer’s pocket. You already gave them $500 million in taxpayer funds to help clean up the mess you let them make and you didn’t have the Orphan Well levy high enough to pay for the mess, and then you allow them to ship all of these wells to weak companies, and then they go bankrupt instead of keeping it in stronger hands to pay to clean up the mess. Your rules, regulations, and loopholes allow these to be taken advantage and in the end, you say there is an obligation to the taxpayer to make the landowner whole? We have a problem with that.”

Another case brought forward was Lexin vs Bateman.

“Lexin was a Chinese company that came into the area about four years ago and automatically they said ‘we’re Chinese, we’re special, and we don’t have to follow the rules in our country so we aren’t going to do it here.’ They didn’t pay any rentals to landowners, they just said ‘we don’t pay annual rentals to landowners’ so they just stopped paying. The Surface Rights Board said ‘that’s strange, we haven’t dealt with that before and it took us about two years to get through the Section 36 process and now the board is saying ‘yes, you have to pay,’” said Bennett. “We had one landowner, Mr. Bateman file against Lexin and it’s a lease out in the middle of his field. There’s a pump jack, a shack, there’s above-ground pipelines, and gravelled access road. More of an intrusion than most of you would experience on your lands.”

With lots of abandoned wells across the province, it leaves landowners in a precarious situation.

“We are realizing 2,500 to 3,000 wells a year in this province. How long that will continue with the Orphan Well Association remains unknown because they are running out of government loans,” stated Bennett. “The AER is addressing termination orders, so if you aren’t getting paid, the board terminates them, unless the company doesn’t exist.”