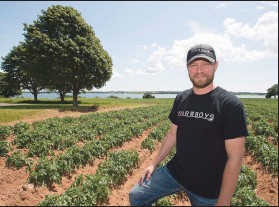

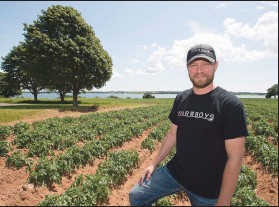

Canadian Press photo

Canadian Press photoA growing number of farmers are nearing retirement without having formally planned for their successors, putting the next generation of smallscale farming at risk

Canadian Press photo

Canadian Press photoA growing number of farmers are nearing retirement without having formally planned for their successors, putting the next generation of smallscale farming at risk

By Jessica Smith Cross, The Canadian Press Posted: Jul 16, 2017 12:49 PM ET Last Updated: Jul 16, 2017 12:54 PM ET

Statistics Canada reports that 92 per cent of Canadian farms have no written transition plan ready for when the current operator retires.

Statistics Canada reports that 92 per cent of Canadian farms have no written transition plan ready for when the current operator retires. (Adrees Latif/Reuters)

2590 shares

Ottawa area hay farmers could lose crop due to record rainfalls

‘Boot camp’ funded by Prince Charles leads retired soldier to a new life on the farm

Bryan Maynard says his grandfather, a Prince Edward Island potato farmer, didn’t start talking about retirement until he was 80 years old and had been diagnosed with dementia.

At that point, with no succession strategy in place, Maynard and his brother suddenly had to scramble to find a way to keep the farm in the family and just barely managed to do so.

The 33-year-old’s situation is not uncommon. A growing number of farmers are nearing retirement without having formally planned for their successors, putting the next generation of small-scale farming at risk — something Maynard and advocates are urging farming families to think about.

Does Canada need family farms?

Syrian farming families get back to the land in Nova Scotia

Homesteading: How P.E.I. couples are reinventing the family farm

“Our grandfather didn’t really want to talk about selling the farm, ever, until it was too late and he had to,” Maynard said.

A Statistics Canada study found last year that the average age of Canadian farmers had reached 55 after rising for decades, and 92 per cent of farms had no written plan for who will take over when the operator retires.

It also found there were more farmers over age 70, than under 35.

It’s just tough to see family farms dwindle up and go the way of the dinosaur…

-Bryan Maynard, P.E.I. potato farmer

Christie Young, of Guelph, Ont., is trying to tackle that issue with Farmlink, a matchmaking service she runs for farm owners and prospective farmers across Canada.

She has found there’s no shortage of young people armed with business plans who want to get into farming, and older farmers who want to see their land farmed by a new generation when they retire.

A new kind of transition

The problem, she said, is that many farmers have become heavily leveraged in recent decades, having borrowed against the rising value of their farm properties — which spiked nearly 40 per cent per acre on average between 2011 and 2016, according to Statistics Canada.

That means farm owners need to sell their properties for full market value in order to retire, said Young, so the only buyers tend to be large agricultural operations consolidating farmland in rural areas or, if the farm is in the shadow of a city, property developers.

“If you’re a new farmer who’s trying to buy a piece of land and pay for it by working the land, it’s almost an impossible proposition,” she said.

Family farming farm farmer Canada

Despite other alarming numbers, Statistics Canada did see an uptick in the number of young, female farmers between 2011 and 2016, the first growth in the under 35 demographic since 1991. (Todd Korol/Reuters)

Young uses Farmlink to help farm owners and young farmers set up partnerships that begin years before the owner’s retirement, such as lease-to-own arrangements that can allow a new farmer to start small and expand.

“The problem is that’s not how building farms has happened in the past — we don’t have a whole lot of history with agriculture, we only have 200 years — and the transition between generations hasn’t looked like this before,” she said.

A successful farm transition tends to require time and planning, so when a farmer comes to Young wanting to sell his property to a new farmer for $5 million by next weekend, she can’t help, she said.

‘It’s just tough to see’

In Maynard’s case, when his grandfather suddenly needed to retire in 2015, he and his brother bought 70 per cent of the farm. They’re successful today, but Maynard said they’re exception to the rule.

He said they just managed to get a loan, secured with a parcel of land that had been willed to them by their father and the financial backing of their mother — assets that aren’t available for most.

“It’s not the way Canadian agriculture should be doing things,” he said. “It’s just tough to see family farms dwindle up and go the way of the dinosaur just because of the lack of planning and lack of resources available to young farmers to help them get off the ground.”

Statistics Canada has, however, identified a small sign of change, finding the number of farmers under age 35 had increased slightly from 2011 to 2016, reaching almost 25,000, with a marked increase in the number of farms run by young women. It’s the first growth in the under 35 demographic since 1991.

High price of admission

Brenda Hsueh attributes some of that growth to a recent trend of many young farmers being motivated by a passion for small-scale organic farming and local food.

She took an unconventional path to farming, buying property in Grey County, Ont., in 2009 at age 33, with funds from the sale of her Toronto condo, which she had bought while working in the financial services industry.

Hsueh was trained to farm by the Collaborative Regional Alliance for Farmer Training in southwestern Ontario, a network of small-scale organic farms that offer internships.

Dairy farm cow

The potential loss of Canadian family farms could affect access to and the price of local foods and produce. (Christinne Muschi/Reuters)

But Hsueh said most of the younger interns she met can’t afford the price of entry to farming today.

That’s why Young said she’d love the federal government to focus more of its farming support on young farmers, rather than on the economic viability of farming in general, fearing that without a change, there will be no more small family farms.

“We’re losing them,” she said.

Farms in thriving communities

Agriculture and Agri-Food Canada said the federal government provides funding and loan support to some young farmers, including loans for farm transitions that allow for deferred payments and interest-only payments.

“We are continuing to explore ways to support the next generation of farmers in starting up and transferring farms,” the ministry said in a statement.

Statistics Canada’s research shows the overall amount of Canadian land being farmed has remained relatively stable over decades, as farms have consolidated to become larger, and the number of farmers has fallen.

“That’s OK if what we care about is GDP and gross farm receipts,” said Young. “But it’s not OK if what we care about is farm livelihoods and farm families and thriving communities.”

© The Canadian Press, 2017

The Canadian Press

6 Jul 2017

Lethbridge Herald

THE CANADIAN PRESS — CALGARY

’’ The entire provincial scheme for protecting Albertans from the abandonment costs in relation to non-productive wells is seriously compromised. – Nigel Bankes – University of Calgary

Alberta’s energy regulator has asked the Supreme Court of Canada to review a ruling that could allow energy companies to walk away from cleaning up abandoned oil wells and affect industrial sites across the country.

In documents filed Tuesday, the regulator formally applied to the top court for leave to appeal the so-called Redwater decision.

In May 2016, an Alberta Queen’s Bench judge ruled in favour of the bankruptcy trustee of Redwater Energy Corp. The court ruled the sale of assets from bankrupt energy companies should go first to creditors, not to cleaning up the mess from the company’s operations.

“The decision’s resulted in unacceptable risks to Albertans and it presents an environmental risk across Canada to all industrial sectors,” said Ryan Bartlett, spokesman for the Alberta Energy Regulator.

The Redwater Energy Corp trustee and its lender, ATB Financial, wanted to sell off the company’s remaining producing wells to pay creditors. They argued a bankruptcy trustee is free to pick and choose from among the company’s assets and disclaim unproductive oil and gas wells.

Disclaimed wells would be abandoned and left to the Orphan Well Association, an industryfunded and government-backed group, to clean up. The regulator argued money from the sale of the productive wells must be used to cover cleanup expenses for the unproductive wells.

But in a 2-1 decision released in April, Alberta’s Appeal Court backed the original judge, saying federal bankruptcy law takes precedence over provincial environmental rules.

Bartlett said that position creates an incentive for producers to offload the costs of cleaning up old, declining wells — especially since the drop in oil prices over the last couple years has increased the number of bankruptcies in the oilpatch.

“Disclaiming unprofitable sites allows companies to reap the benefits of natural resources while avoiding the costs to repair the land,” he said. “It can permanently impair the environment, the economy and safety of Albertans.”

Legal experts have also pointed out the case exposes a conflict between federal and provincial law.

“The practical effect of this decision is that the (regulator’s) authority to enforce abandonment orders at the cost of the licensee is unenforceable at precisely the time when the (regulator) most needs to be able to exercise that power — i.e. when the licensee is insolvent,” Nigel Bankes, chairman of resource law at the University of Calgary, wrote in an Alberta law blog.

“The entire provincial scheme for protecting Albertans from the abandonment costs in relation to non-productive wells is seriously compromised.”

The case is being watched across Canada. Both British Columbia and Saskatchewan have backed the regulator’s request for an appeal. The Farmers’ Advocate Office and Dene Tha’ First Nation also support it.

The regulator said that since the Redwater decision came down, about 1,000 sites have been disclaimed with estimated liabilities of more than $56 million. The Orphan Well Association’s inventory has more than doubled from almost 1,200 to more than 3,200.

In May, the growing backlog of abandoned wells prompted the Alberta government to loan the association $235 million to hasten their cleanup.

14 Jun 2017

Lethbridge Herald

OUR EDITORIAL: WHAT WE THINK

One of the most important qualifications in adjudicating matters of any kind is impartiality. Whether it involves a judge in a court case, a referee officiating a game, an arbitrator handling a labour mediation or a volunteer judging jams at a local fair, it’s vital that the person making the decisions is completely unbiased.

Objectivity is similarly and especially crucial in matters to do with the federal government. People chosen to serve as independent watchdogs overseeing government activities must indeed be independent. There can be no hint of partisanship that might influence, or even give the appearance of influencing, the decision-making process.

It’s with that in mind that the New Democrats are proposing a change in the way independent federal watchdogs are selected. The NDP are pushing to establish a multi-party committee that would have to approve people nominated by the federal government to serve as officers of Parliament. That would apply to the roles of auditor general, chief electoral officer and commissioners of ethics, lobbying, information, privacy, official languages and public sector integrity, as well as to the parliamentary budget officer, clerk of the House of Commons and chief parliamentary librarian.

The motion, which is to be voted on today or Thursday, comes in the wake of criticism over Prime Minister Justin Trudeau’s choice to fill the post as official languages commissioner.

Trudeau’s pick — fellow Liberal Madeleine Meilleur — is a former Ontario cabinet minister who in the past had donated to both the federal Liberal party and to Trudeau’s leadership campaign. Those partisan links not surprisingly raised concerns about her ability to properly hold the government to account in the role of bilingualism watchdog. Trudeau was also slammed for not consulting opposition parties about his choice, which is a legal requirement for officers of Parliament.

Meilleur defended her integrity before the Senate last week, noting, “In my prior positions, I have always been fully impartial,” but withdrew her candidacy two days later in the face of the criticism.

Nathan Cullen, the NDP ethnics critic, calls his party’s motion an “elegant solution” that will make sure partisan choices for federal watchdog jobs aren’t repeated.

Chantal Hébert, national affairs columnist with the Toronto Star, wrote of the Meilleur controversy: “This comes at a time when the Liberal government has presented legislation that could clip the wings of the parliamentary budget officer. To say that there is widespread opposition suspicion that the Liberals like watchdogs best when they are on a leash — just as their predecessors did — is an understatement.”

Federal watchdogs, including the auditor general and parliamentary budget officer, have often made governments uncomfortable with their findings in the past. That’s their job, to hold governments accountable, and that’s the way it should be in a healthy democracy.

If watchdogs are going to become nothing more than toothless lapdogs, their role defeats the purpose, and the taxpayers’ money that goes to paying their lucrative salaries is money down the drain. What we need are watchdogs with teeth and free run to do their jobs properly.

Comment on this editorial online at www.lethbridgeherald.com/ opinions/.

14 Jun 2017

Lethbridge Herald

Ben Eisen and Steve Lafleur THE FRASER INSTITUTE – VANCOUVER

Over the past decade, Ontario emerged as the poster child for poor fiscal management in Canada, due largely to the province’s deep run of deficits.

However, thanks to a decade of rapid spending growth and painful decline in oil prices, Alberta’s run of deficits is even worse than the biggest deficits of Ontario’s recent depressing fiscal history.

Up until the start of Alberta’s recent recession, Ontario’s per-person deficits were more than twice as large as any deficits run by any other large province since the turn of the century, peaking at $1,661 per Ontarian in 2009-10. (All amounts are in 2015 dollars.)

Remarkably, Alberta’s budget deficit in 2015-16 was $2,513 per person — about 50 per cent larger. What’s worse, Alberta is set to run another deficit of almost the same size this year.

Moreover, Alberta’s budget plan calls for continued deficits — which will be, per person, consistently larger than Ontario’s during its recent fiscal crunch — for the remainder of its fiscal plan.

Deficits are the difference between what a government spends on operating expenses and what it collects during a given year. Deficits contribute to a province’s overall debt — debt refers to liabilities acquired over a province’s entire history, not just a single year. The bigger the annual deficits, the faster the debt adds up, which means more taxpayer money spent on interest payments and a bigger burden passed on to future generations.

The silver lining for Albertans is that their province entered this string of large budget deficits with a lower baseline debt than Ontario in 2008-09. In fact, until last year Alberta was the only province with no net debt, meaning its financial assets exceeded its debts. Due to this better starting point, Alberta has a substantially smaller debt burden than Ontario despite the big deficits being run.

Ontario’s per-person net debt (a measure that adjusts for financial assets) has stabilized at approximately $22,000 whereas Alberta became a net debtor only last year, and so doesn’t yet carry a substantial net debt.

But the gap between the two provinces is shrinking quickly. Alberta’s fiscal plan calls for the province’s net debt to reach approximately $9,500 per person by 2019-20. Just four years removed from being Canada’s only debt-free province, Alberta will have racked up approximately 40 per cent as much debt per person as heavily indebted Ontario.

So it’s not hard to see that Alberta’s per-person debt could quickly catch up to Ontario’s — and much faster than some might assume, unless the pace of debt accumulation is slowed considerably.

In the years following the 2008-09 recession, Ontario ran budget deficits the likes of which hadn’t been seen in any large province in Canada since the mid-1990s.

But Alberta, with its oceans of red ink, is Canada’s new poster child for large sustained budget deficits.

Ben Eisen and Steve Lafleur are analysts with the Fraser Institute and coauthors of Race to the Bottom: Comparing the Recent Deficits of Alberta and Ontario. Distributed by Troy Media.

CBC News Posted: May 16, 2017 10:37 AM ETLast Updated: May 16, 2017 11:52 AM ET

A truck carrying wood goes through the customs checkpointin Champlain, N.Y. Canadian lumber imports into the United States face new duties ranging from three to 24 per cent. (Ryan Remiorz/Canadian Press)

A group of Quebec mayors made its case in Washington, D.C. today for a quick end to the dispute over softwood lumber, which has hurt the industry in the province.

Communities across the province depend on the industry, said Drummondville Mayor Alexandre Cusson, who led a trade mission to the U.S. capital.

“We’re looking for a win-win agreement, as quickly as possible,” he said at a news conference Tuesday.

The comments come as the federal government’s aid package for the softwood lumber industry is expected to go before cabinet for final approval.

Sources tell CBC News the package will contain a “substantial” envelope of money — just under a billion dollars — to help the sector struggling to cope with new tariffs recently imposed by the U.S. Department of Commerce.

Cusson and other representatives from the Union of Quebec Municipalities met with both allies and opponents in the dispute, including members of the U.S. Lumber Coalition, a lobby group representing American sawmills.

He was accompanied in Washington, D.C., by the mayors from Rivière-Rouge, Saint-Félicien, Senneterre and Val-d’Or — all communities dependant on the lumber industry.

Quebec sawmills have already been forced to adjust their output to deal with lower demand from the U.S. following the introduction of the new tax.

On Monday, Quebec-based Resolute Forest Products cut shifts at seven sawmills and delayed the start of forest operations, affecting 1,282 workers.

Roughly 90 per cent of Quebec’s lumber exports head to the U.S. and the forestry sector accounts for 60,000 jobs in Quebec.

During the last softwood lumber dispute, Canada shed 20,000 forestry jobs between 2000 and 2006, and about 400 sawmills closed entirely between 2004 and 2009.

Quebec Premier Philippe Couillard doesn’t expect the federal government to loan the province any money to subsidize the softwood lumber industry. This comes after the announcement that tariffs will be imposed on Canada’s softwood lumber exports to the United States.

On Monday, Couillard confirmed that it was important for the Trudeau government to place measures that are “complimentary” to those set out by Quebec.

If the federal government wants to help, the premier said that it doesn’t “necessarily” need to double the $300 million that Quebec is ready to inject.

According to Couillard, it is important that the Trudeau government helps the forest industry by pointing it towards new products and markets.

Aside from the five industry giants – like Produits forestiers Résolu – the Trump administration imposed a 19,88 per cent retroactive tariff on Quebec and Ontario lumber producers. The American government is expected to announced a decision regarding antidumping rights on June 23.

Following the announcement that tariffs will be imposed on Canada’s softwood lumber exports to the United States, a new campaign is being launched to promote the industry in Quebec.

With a $4.2-million budget the three-year campaign, titled “Une forêt de possibilités,” will outline a number of ways the potential of Quebec’s forests can be harnessed. This announcement came right as 1300 Résolu employees were forced to take leave due to a conflict about commercial lumber.

The Couillard government is providing $2.7 million of the campaign’s budget, along with $1.35 million from the Quebec Forest Industry Council.

By Nola Keeler, CBC News Posted: May 09, 2017 1:44 PM MTLast Updated: May 09, 2017 1:44 PM MT

Alberta could see up to nearly a third of its energy coming from wind generation and other renewable energy sources in the next 15 years. (CBC)

Alberta has huge potential to produce clean energy from wind but so far it is largely untapped, delegates to a conference on wind-generated electricity were told in Edmonton Tuesday.

Even though Alberta was the site of Canada’s first commercial wind farm in 1993, it has fallen behind other provinces in wind power.

Both Saskatchewan and Prince Edward Island get more of their electricity from wind than Alberta does.

Right now, Alberta has 901 wind turbines with total capacity to generate 1,479 megawatts of electricity, about six per cent of electricity demand.

But with the province phasing out coal-generated electricity, there is big potential for growing the wind-power industry. The province is the largest market in Canada for new wind-power generating capacity.

“Wind is now the cheapest source of non-greenhouse gas emitting electricity in Canada and along with natural gas, it’s the cheapest source of electricity generation, period,” Robert Hornung, president of the Canadian Wind Energy Association (CanWEA), told the organization’s Alberta Summit conference.

Over the last 10 years, there’s been more new wind generating electricity capacity built than any other form of generation, Hornung said.

“So it’s really moved from being a niche source of energy like it was when Alberta got started, to now it’s very much in the mainstream and one of the fastest growing sources of electricity in the world.”

Even more traditional sources of electricity are getting on board with wind power, said Mark Salkeld, president and CEO of the Petroleum Services Association of Canada.

“It’s business opportunity, absolutely,” Salkeld said. “It’s the entrepreneurial spirit of Albertans, of Canadians to see these opportunities. They’re not being kicked and dragged into this energy mixed future. They’re leading the charge.”

Canada needs a mix of different types of energy in the future, he said.

“We’re going to need wind, we’re going to need oil and gas, for generations yet to come.”

CanWEA says Alberta’s demand for energy from renewable, green sources is expected to triple to as much as 30 per cent in the next 15 years.

The industry is also looking at the possibility of one day exporting wind energy, said Hornung.

He said wind power could provide a lot of benefits to the Alberta economy.

“That promises some real benefits for Albertans, the communities that host the projects, but Alberta overall in terms of new economic opportunities.”

By Alexander Panetta

The Canadian Press

Posted: May 05, 2017 3:36 PM ET Last Updated: May 05, 2017 3:49 PM ET

Prime Minister Justin Trudeau has written B.C premier Clark to tell her he is considering request for a ban or a tax on thermal coal exports from the U.S.

The Canadian government is threatening multiple trade actions against the United States in retaliation for duties on softwood lumber, demanding a long-term deal without which several American industries could soon be targeted.

Prime Minister Justin Trudeau launched the first salvo in a letter to B.C. Premier Christy Clark, informing her that he’s seriously considering her request for a ban on thermal coal exports and that it’s being explored by federal trade officials.

Clark, who is currently campaigning for another term as B.C. premier, was quick to release a statement responding to Trudeau’s letter.

“I would like to thank Prime Minister Trudeau for his quick action to look at banning thermal coal exports through British Columbia and his commitment to stand up for B.C. and Canadian forest workers,” she said.

About 94 per cent of the thermal coal shipped through the province comes from the United States and is bound for Asia, but Alberta also ships it to B.C.’s coast.

The second threat: possible duties against Oregon industries. That’s the home state of a Democratic senator, Ron Wyden, who has been a hardliner on the lumber dispute.

Christy Clark threatens thermal coal levy in retaliation for U.S. softwood dispute

The Canadian government has found several Oregon business-assistance programs it says may constitute illegal subsidies. It’s considering a process that could lead to retaliatory duties on imports from that state’s products, such as plywood, flooring, wood chips, packaging material and wine.

Two government sources told The Canadian Press the threat has nothing to do with U.S. President Donald Trump; they say it’s a one-off, specific action related to one dispute, and one Democratic senator in one state.

They say a long-term deal on softwood lumber would be the best way to prevent the dispute from escalating.

“We hope we don’t have to act,” one source told The Canadian Press, speaking on condition of anonymity in order to discuss matters not yet made public. “We hope this dispute can be resolved.”

FWIW- The PMO gave us a heads up on this. Though the letter doesn’t make it clear. We’re told AB coal would be exempted. #ableg #bcelxn17 https://t.co/IQ9mi6WEL3

— @cherylanne

The course of action being reviewed by the Canadian government is similar to the process used in the U.S. that slapped a 20-per-cent duty on northern lumber. It involves a request to the Canada Border Services Agency to study illegal subsidies in Oregon, a process that would take several months.

The government says it has zeroed in on nine programs in Oregon that assist businesses, primarily in lumber.

They include: the Oregon Underproductive Forestland Tax Credit, the Oregon Forest Resource Trust, the Oregon Tree Farm Program, the Pacific Forest Trust, property tax exemptions for standing timber, a small winery tax exemption program and other tax credits.

“It’s a real thing. Our officials have already been looking at this,” said one government official familiar with the plan. “Wyden has been a chief proponent for years of the baseless and unfounded claims against the Canadian softwood lumber industry.”

Another official said there’s no intention of changing the low-drama, co-operative posture Trudeau has taken toward the White House: “This is not about the president. This is about the state… The strategy (with Trump) is still one of positive engagement…

“(But) we still have to respond to these issues as they come.”

By Ross Marowits

The Canadian Press

Stacks of lumber are shown at NMV Lumber in Merritt, B.C., Tuesday, May 2, 2017. Several American companies that rely on Canadian softwood say thousands of American jobs are at risk unless the U.S. Department of Commerce exempts them from hefty duties imposed on imported softwood lumber.

Stacks of lumber are shown at NMV Lumber in Merritt, B.C., Tuesday, May 2, 2017. Several American companies that rely on Canadian softwood say thousands of American jobs are at risk unless the U.S. Department of Commerce exempts them from hefty duties imposed on imported softwood lumber.

Several American companies that rely on Canadian softwood say thousands of American jobs are at risk unless the U.S. Department of Commerce exempts them from hefty duties imposed on imported softwood lumber.

The U.S. owners of three bed-frame makers and a company that transforms yellow cedar into high-end products have appealed to Commerce Secretary Wilbur Ross to be exempted from 20 per cent average countervailing duties and impending anti-dumping charges on Canadian imports.

Without a dispensation, the companies said they would be forced to substantially raise prices, risking lower sales and job losses.

“Disruptions, even if temporary, will eliminate jobs in the U.S. and damage the financial stability of the U.S. mattress manufacturing base,” wrote Stephen McLaughlin, vice-president global sourcing for Kentucky-based Tempur-Pedic.

Similar letters sent by other companies were posed on the Department of Commerce website.

They said U.S. lumber mills that launched the trade action against Canada support its request, but the government said it would only respond when it issues its final duty determinations in about five months.

The mattress frame companies said the wood they need has small knots and fine grain, characteristic of softwood species grown in colder climates like Canada.

Oregon Industrial Lumber Products Inc. said it buys all its yellow cedar from British Columbia because none is produced in the U.S. besides small quantities in Alaska.

Owner Murray McDowell said companies like his will be “collateral damage” in the efforts to protect U.S. lumber producers.

“With no exclusions, we will be effectively run out of business,” he wrote.

Copyright © 2026 · Enterprise Child Theme on Genesis Framework · WordPress · Log in