Alberta’s farmers’ property rights under attack by the energy industry and the UCP government

Group cleaning up old oil wells says Alberta government rules inadequate

8 hrs ago

The Canadian Press

EDMONTON — A group tasked with cleaning up thousands of abandoned energy facilities in Alberta says the province’s rules for ensuring polluters reclaim their wells before selling them off are inadequate.

The industry-funded Orphan Well Association made the criticism in a letter to Alberta’s energy regulator, which is considering a proposed transfer of hundreds of toxic gas wells, pipelines and other facilities from an energy giant to a much smaller company.

“The (association) has seen a dramatic increase in the number of orphan properties over the last several years and we believe part of the issue stems from a historically inadequate assessment of the transfer risks,” says the letter from association head Lars DePauw.

“The (association) believes that the current regulatory system for assessing the overall financial viability of asset transfers is not adequate and needs to be augmented.”

Shell Canada has agreed to sell 284 sour gas wells, 66 facilities and 82 pipelines in the southern Alberta foothills to Pieridae Energy, a Calgary-based company with a market value less than the price of the assets and a stock price under $1.

The Alberta Energy Regulator must rule on the licence transfers at a time when the inventory of energy facilities abandoned by bankrupt companies grows.

The number of wells transferred to the association sits at 3,400. Alberta has budgeted more than $70 million for cleanup by 2023 — a more than 50 per cent increase in otherwise belt-tightening times.

“We believe that the applications represent an extraordinary situation in the current Alberta market,” the association said in the Dec. 5 letter.

Pieridae has said it will retain Shell employees who are expert in handling sour gas. It also said the transaction meets provincial rules that stipulate a purchaser’s assets must be at least twice its liabilities before licence transfers are approved.

Regan Boychuk of the Alberta Liabilities Disclosure Project, a group of academics and landowners who have filed concerns about the Pieridae transfer, said those measurements are not credible.

Assets are calculated on the basis of the average industry profit per barrel of oil. That figure — now $37 — hasn’t changed since 2010, when oil sold for about $100 a barrel.

That average is supposed to be recalculated every three years, said Boychuk.

“The regulator has never followed its own policy,” he said. “It is not a proper accounting of the cost of this type of work.”

Concerns about the transfer are shared by at least two major energy companies.

“Pieridae has been operating at a loss since it began operations,” said a letter from Cenovus to the energy regulator. “Material uncertainties exist around their ability to continue as a going concern.”

“Pieridae Energy Limited (has) limited on-hand financial resources to address the current and future liabilities associated with operating the assets,” said Canadian Natural Resources.

“If the licence transfers are allowed, there is a high probability that Pieridae will be unable to respond to circumstances should any operational, health, safety or environmental problems arise.”

Both companies said the association could get stuck with a $500-million bill if Pieridae is unable to clean up.

Worries about safety and cleanup are echoed by 14 area landowners.

“This looks like the old shell game,” wrote Michael O’Keefe of Cochrane.

Sharon Rubeling of Rocky Mountain House points out Pieridae is partly financed through a Toronto company behind a previous asset transfer that eventually left hundreds of wells orphaned.

She adds that Albertans are already invested in Pieridae through loans from AIMCo, which administers public pensions in Alberta. AIMCo also owns five million shares in Pieridae.

This report by The Canadian Press was first published Jan. 15, 2020

— Follow Bob Weber @row1960 on Twitter

Bob Weber, The Canadian Press

Alberta ranchers, farmers furious over oil and gas companies’ failure to clean up their geriatric wells

And they’re concerned an extra 93,805 wells could become orphaned given Alberta’s economic outlook, completely overwhelming clean-up efforts

Geoffrey Morgan

Updated: December 18, 2019

Calgary Herald

Geriatric orphan wells, boomtowns going bust and the fate of coal-mining towns in the age of renewables: In a four-part series, FP visits Alberta’s forgotten small communities to see how they are struggling with changes in the broader economy.

CALGARY – In 1897, a German aristocrat named Count Alfred von Hammerstein was on a journey to the Yukon, where he hoped to make a fortune during the Klondike gold rush. As he arrived in what would later be called Alberta, he decided to stay and try to exploit the reserves of black gold in the oilsands.

Von Hammerstein raised money to sail drilling crews down the Athabasca River on sometimes ill-fated expeditions north of Fort McMurray. On one river trip, two members of the crew drowned. On another, the count’s leg was injured in what historical records vaguely describe as a “shooting accident.” In the end, the 14 wells he drilled, all before 1909, were unsuccessful.

The count learned “the oilsands would not give up their secrets easily,” according to an Alberta government report written in 1978, but he has since been ensconced as “one of the most colourful characters” in the Canadian Petroleum Hall of Fame.

But one of the wells von Hammerstein drilled has a more inglorious history. The well, drilled in 1906 or 1907 near the First Nations community of Fort McKay, is believed to be the province’s oldest orphan well, meaning nobody is financially responsible for cleaning it up.

Von Hammerstein died in 1941, long before wildcatters needed reclamation certificates for the wells they drilled. Indeed, the count never even obtained a drilling licence.

That well may be the oldest orphan, but it’s not an outlier since there are some 3,406 orphan wells listed in the Orphan Well Association’s clean-up list and that’s not sitting well with landowners.

Farmers, ranchers and their lawyers say they’re furious that oil and gas companies are failing to clean up after themselves and they’re concerned that an additional 93,805 inactive wells could become orphaned given Alberta’s economic outlook, which would completely overwhelm both the Alberta Energy Regulator (AER) and the provincial government.

“The claim that Alberta’s oil and gas is the most ethically produced oil because of the environmentally and socially responsible way in which it’s produced is true only to an extent, and where it’s not true and where the government and industry need to up their game is in dealing with the legacy wells,” said Keith Wilson, a St. Albert, Alta.-based lawyer who represents landowners in fights with energy companies.

Wilson said farmers and ranchers have historically counted themselves among the energy industry’s biggest supporters and they routinely sign lease agreements that allow companies to access their land. But the relationship has soured as Alberta’s economy has tanked and landowners encounter problems with both collecting rental payments and getting companies to clean up old contaminated sites.

Geriatric orphan wells such as Von Hammerstein’s are a particular sore spot for farmers, because older wells are more likely to contaminate the ground, are more difficult to clean up and take more time to remediate since they were drilled in an age when environmental standards were more lax.

Wilson, who has fought in court to force delinquent companies into cleaning up geriatric wells, said older wells are also more likely to be plagued with rusted out down-hole equipment and he frequently sees wells with cracked cement linings, leading to an increased likelihood that contaminants will flow into the earth.

Moreover, he said, most oil and gas companies prior to the 1990s used pits, dug right next to a well, rather than tanks, to store the fluids and mud used in drilling the well and production. Those pits, he said, dramatically complicate the remediation efforts of older wells because freezing and thawing every winter and spring sends the contaminants deeper into the ground, further spreading any contamination.

Satellite images show one old orphan well near Lloydminster, on the Alberta/Saskatchewan border, encircled by an unnaturally dark shade of brown. The well was drilled during the Second World War on July 25, 1941, and produced a total of 17,052 barrels of oil. Now, 78 years later, it has yet to be fully remediated.

“If you’re an oil company and you’ve got 1,000 old inactive wells and you’ve got 100 new inactive wells, you can probably clean up all those new minimum-disturbance, coal-bed methane wells for the cost of cleaning up one or two of those old historic 1950s-era wells,” Wilson said.

In November 2018, the AER issued a statement that pinned the environmental liability for cleaning up oil and gas infrastructure in the province at $58.65 billion. That admission came after one of the regulator’s vice-presidents said during a presentation that the number could be as high as $260 billion, a figure that included oilsands mining remediation.

Either way, the problem is daunting.

The Financial Post sorted through well data from before 1964, the year the Alberta government started requiring companies to obtain reclamation certificates for cleaning up their oil and gas wells, and found 6,077 wells that are still active today. An additional 5,487 wells have suspended production but have not been cleaned up, and 3,695 wells have been plugged, a state the industry and government calls “abandoned,” but not remediated.

Altogether, there are 15,259 wells drilled before 1964 that have not been remediated, or 39.6 per cent of 38,491 wells drilled before that date.

In addition, 18,266 of the wells drilled prior to 1964 are exempt from reclamation certificates.

“Not every old one is complicated,” said Lars DePauw, executive director of the Orphan Well Association (OWA), which is funded through a levy paid by the industry and collected by the AER.

DePauw said the association prioritizes wells to clean up by their potential threat to public safety. Any well that could be releasing hydrogen disulphide gas is cleaned up first. He said the OWA targets wells in specific regions in area-based closure programs. “After that, we get to chronology,” he said.

Since November 2018, the OWA has been working on Von Hammerstein’s orphan well. It first plugged the well with cement, monitored it for a year and then capped the well bore last month, though additional work is being planned.

The OWA had been remediating 60 wells per year, but the oil price crash and resulting bankruptcies have forced the association to increase that to 1,000 annually.

One of the largest single funders of the OWA, by virtue of its size, is Calgary-based Canadian Natural Resources Ltd.

According to farmers and surface rights lawyers, CNRL, which produces more than one million barrels of oil and gas per day, is also one of the most active at cleaning up.

The company is a “top performer” in the number of inactive wells it reclaims, spokesperson Nicholas Gafuik said in an emailed statement. “In 2018, we abandoned 1,293 wells and submitted 1,012 reclamation certificates. In 2019, Canadian Natural is targeting approximately 2,000 wells to be abandoned.”

Gafuik said the company supports the AER’s area-based closure approach because it accelerates the pace of reclamation by being cost effective. “By strategically grouping well and pipeline abandonment by area, we increase efficiencies and manage our impact on the land better,” he said.

Farmers and lawyers praise CNRL’s pro-activeness and the OWA’s attempt to accelerate remediation efforts, but remain concerned by the magnitude of the problem. At the current pace, it would take the OWA and CNRL, the two most active well remediation organizations in the province, 32 years to clean up all the inactive and orphan wells in Alberta.

Daryl Bennett, a farmer in the Municipal District of Taber, said he has wells drilled in the 1940s and 1950s on his property. He calls them “bottom dwellers” and his frustration getting them remediated led him to get involved with local surface rights groups and advocate on behalf of farmers and ranchers dealing with oil and gas producers.

Given the challenges inherent in cleaning up older wells, Bennett said he and other landowners in Southern Alberta have been seeking approvals to build solar power installations on top of old well sites. Renewable power installations, he said, would allow farmers to earn money off land that has previously been contaminated.

“At some point, (the Alberta government or the OWA) are going to be buying some land,” he said.

Other landowners are concerned that given the dire state of Alberta’s economy — anemic economic growth, provincial government austerity budgets and low commodity prices — the unfunded liability will be dropped on farmers and ranchers.

“Knock on wood, hope the landowner won’t be doing the reclamation,” said Graham Gilchrist, principal at Gilchrist Consulting in Leduc, who advises farmers and ranchers in the area around Edmonton on dealing with orphan wells and delinquent rental payments from energy companies.

Gilchrist and Bennett both believe Alberta needs a bonding system that forces companies wanting to drill a well to first post collateral so that neither taxpayers nor landowners are ever responsible for the costs of cleaning up orphaned or inactive oil wells.

Lawyers and researchers have also described the need for legislated time limits on cleaning up inactive wells, which they said would dramatically reduce the backlog of 93,805 inactive wells that could be tomorrow’s orphans.

In both Texas and North Dakota, two states that produce large volumes of oil and gas, bonds and time limits have resulted in far fewer orphaned wells and fewer long-term inactive wells than exist in Alberta. Texas was also able to reduce its backlog of orphan sites.

In years past, the Alberta government and industry groups have resisted set time limits to clean up old wells because they said inactive older wells can still be economically viable during periods of higher oil and gas prices.

But historical data show that 60-year-old wells only have a one-per-cent chance of being reactivated in that scenario, according to a study by University of Calgary economist Lucija Muehlenbachs that was published in the International Economic Review in February 2015.

“The probability that an inactive well is going to be reactivated decreases the older it is,” she said. “These inactive wells are not getting reactivated.”

Time limits in Alberta have been successful in the past, but the province has not required bonds prior to drilling activity.

Alberta regulators first introduced a “special well fund” to finance the cost of plugging wells in 1986. Then, in 1993, the government introduced the first levy for orphan wells and began screening the risk that oil and gas companies might orphan their wells by keeping a ratio of how many inactive wells a company owns relative to its active wells.

The government in 1997 then implemented the Long Term Inactive Well Program, which pushed oil and gas companies to be more proactive within stricter time limits.

“That 1997 program was pretty effective,” said Barry Robinson, a lawyer at Ecojustice Canada who acts on behalf of farmers and ranchers, noting that the program included a five-year time frame for plugging inactive oil and gas wells.

That program was replaced in 2000 with the current system that does not include time limits on well remediation.

Robinson said one client in Pincher Creek, in the southwestern corner of the province, has a well that was drilled on his land in 1957.

“This well was drilled when his father owned the land and now he’s saying, ‘I don’t want to pass this onto my kid,’” he said, noting the problem has become an intergenerational one.

This well was drilled when his father owned the land and now he’s saying, ‘I don’t want to pass this onto my kid’

Barry Robinson, a lawyer at Ecojustice Canada

In 1995, Robinson said, there were 12,000 inactive wells in Alberta, but that has since ballooned 680 per cent.

A February 2018 presentation by Robert Wadsworth, AER vice-president, closure and liability, showed the number of inactive wells has grown at a rate of six per cent per year since 2000.

Alberta’s current government faces a dual challenge when dealing with the problem. Farmers and ranchers voted in massive numbers for the United Conservatives in the provincial election earlier this year, helping UCP candidates beat NDP candidates in many rural ridings by tens of thousands of votes. However, the UCP also promised to reinvigorate the energy sector by removing red tape and encouraging investment.

Now, with two parts of the government’s support base locked in fights over orphan wells, delinquent rental payments and rural property tax arrears, the province is reconsidering existing legislation as it conducts a full review of the AER.

“Currently, the government is working with the Alberta Energy Regulator and industry to review the liability management framework in Alberta,” Energy Minister Sonya Savage said in an email. “Our government wants to ensure that the economic environment exists for private industry to be successful and able to bear the costs of well abandonment.”

In recent weeks, Premier Jason Kenney has asked Ottawa for financial assistance to help remediate orphaned wells as a way to put unemployed oil and gas workers in rural areas back to work.

Various provincial governments in Alberta, including the recently ousted NDP, have formed panels on how to handle the problem of orphan wells, but it has only continued to grow in the 114 years since Alberta was formed.

Indeed, Alfred von Hammerstein’s orphan well north of Fort McMurray has remained unremediated for almost the entire history of the province, which was created by former prime minister Wilfrid Laurier in 1905. Thousands of other old inactive wells and legacy orphan wells have never been cleaned up either.

“What we’re seeing is a complete lack of action,” said Wilson, adding that company money during oil booms typically gets allocated to new drilling programs, while government money is allocated to building new infrastructure. “The excuse that these wells can be economic and reactivated if prices return to historic highs is false, because we’ve been through those cycles and no work has been done.”

Financial Post

As Alberta energy companies struggle to pay their bills, farmers, ranchers and counties feel the pinch

Geoffrey Morgan

December 12, 2019

11:29 AM EST

Last Updated

December 13, 2019

11:48 AM EST

Financial Post

Oil companies’ late or delinquent payments on land leases and municipal taxes are exposing fissures in Alberta’s rural communities

Geriatric orphan wells, boomtowns going bust and the fate of coal-mining towns in the age of renewables. In a four-part series, FP visits Alberta’s forgotten small communities to see how they are struggling with changes in the broader economy.

CALGARY – Andy Hofer and members of his Hutterite colony in northwestern Alberta have been embroiled in an increasingly common dispute in recent years. So common that the Hutterian Brethren Church of Grandview, where Hofer is the field manager, has been in at least eight such disputes in the past year.

Like many farms in the province, the religious agricultural commune, in an attempt to supplement its income, has signed lease agreements with oil and gas companies that want to drill their land for hydrocarbons.

But as commodity prices have tumbled for both oil and natural gas, those rental payments have either dried up or, in some cases, disappeared. In the past year alone, the Hutterite colony has won eight cases at the Alberta Surface Rights Board against energy companies that either weren’t paying rent or tried to unilaterally reduce their rental payments.

See Also:

- Far from the spotlight, small-town Alberta suffers in upheaval sweeping energy sector

- A tale of two Alberta towns: One in the throes of a boom, the other mired in the energy downturn

- Retraining oil and gas workers sounds like an easy solution, but the reality is incredibly complex

“It was a fight at the start,” said Hofer, adding that his colony near Grande Prairie has 80 such lease agreements. “They tried to reduce (the rent) and it was difficult getting more money.”

What was once a mutually profitable relationship between oil companies and the farmers, ranchers and counties who own the land they work on has become increasingly strained in recent years. Landowners and county reeves say they’ve had to fight for both rent and even municipal tax payments from a growing number of energy producers.

Those fights have resulted in drawn-out legal battles with companies farmers and ranchers once considered partners, while counties with massive municipal property tax arrears are being forced to dip into savings to balance their budgets or pass additional costs onto residents, who are sometimes the same farmers dealing with unpaid oil and gas rents.

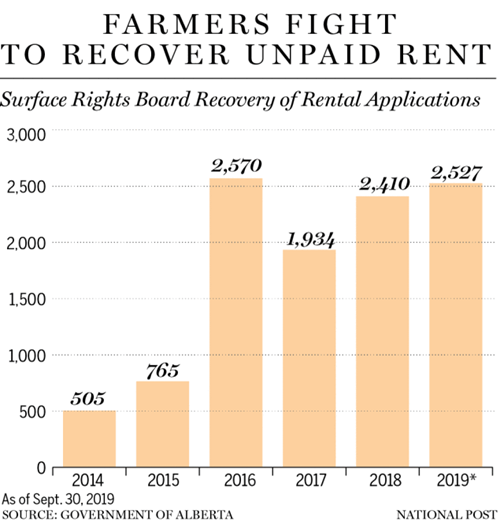

The problem has become so widespread that applications to the Surface Rights Board, the provincial tribunal that assists landowners, occupants and operators resolve disputes about surface access and compensation, to recover unpaid rents have soared.

More than 2,500 applications were made in the first nine months of 2019 compared to 505 motions in all of 2014. The number of applications so far in 2019 has already surpassed the entire 2018 total of 2,410.

“The board is swamped,” said Daryl Bennett, a farmer and advocate for landowners in the Municipal District of Taber, just east of Lethbridge.

He said landowners are forced to wait years for payment decisions as a result of the glut of applications and some long-awaited decisions are rendered with “lots of mistakes” since the board does not have the staff required to properly deal with the volume of complaints.

One thing is clear: the delinquent payments are exposing fissures in Alberta’s rural communities.

Farmers and ranchers own the surface rights to the land, while oil and gas companies own the mineral rights beneath the surface. Contracts in years past were negotiated to allow both sides to profit as farmers and ranchers could earn rental income by allowing exploration and production companies to put drilling rigs and pump jacks on their lands and exploit any reserves.

When the lease payments stop — either due to bankruptcy or companies looking to reduce their rent — landowners don’t have the luxury of handing out an eviction notice. Once a well is drilled and encased in cement, it’s a permanent fixture on the land until its fully remediated and that process takes years.

Increasingly, landowners are angry about having to chase oil companies for payments and, sometimes being forced to wait years for the Surface Rights Board to settle the disputes. At the same time, Canadian agricultural exports have been shut out of critical markets such as China, further handicapping already cash-strapped farms and ranches.

The agriculture sector is also competing for space on railway lines to move their grain to ports, because oil companies are shipping more of their product on rail cars due to the shortage of pipelines.

Oil-by-rail exports hit 319,594 barrels per day in September, which is approaching the record high of 337,260 bpd set in December 2018 and double the five-year average of 159,584 bpd, according to the Canada Energy Regulator.

Canadian National Railway Co. data show it has moved 8.8 million tonnes of Western Canadian bulk grain this year through the end of November, which is a six per cent decrease relative to last year and a two per cent decrease relative to the three-year average.

But more than just farmers and ranchers are affected by energy companies looking to reduce their expenses.

County reeves and representatives for rural districts report that companies, particularly natural gas producers that have struggled with low commodity prices in recent years, are either late or delinquent in paying their municipal taxes.

Rural Municipalities of Alberta (RMA) president Al Kemmere said counties and rural municipalities “are seeing an increase in the number of taxes not being able to be collected compared with last year.”

Last year, the association reported communities were unable to collect $81 million in municipal taxes, with most of the arrears coming from energy sector companies.

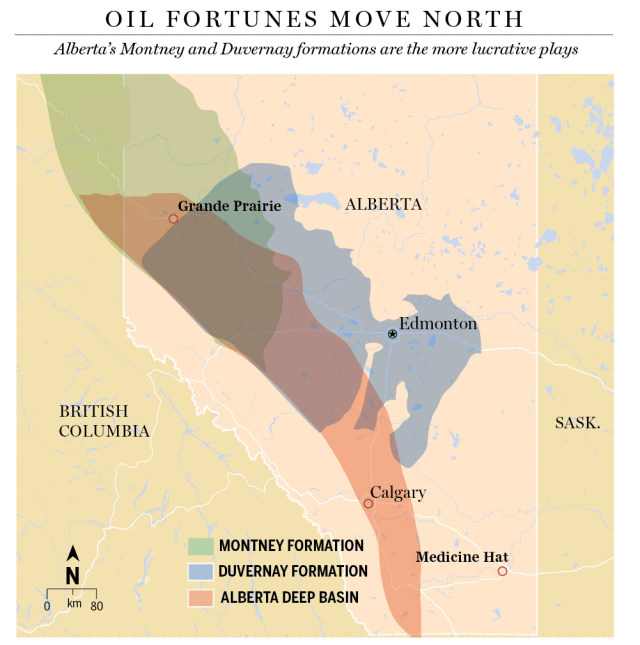

The strain is exposing financial weaknesses in different pockets of Alberta, because oil and gas exploration and production has moved from conventional formations in the south to more lucrative, deeper-lying unconventional formations such as the Montney, Duvernay and oilsands in the north.

A review of the balance sheets of every rural municipality and county in the province finds a large division in the financial fortunes of Alberta’s counties in the deep south and those sitting on hot plays in the north.

The financial statements show that counties and rural municipalities in active oil and gas hotspots have accumulated large surpluses. For example, Wood Buffalo is home to the oilsands and reported a $5-billion surplus in 2018. The County of Grande Prairie, at the heart of the Montney and Duvernay formations, has a surplus of $543 million.

The 10 richest counties and rural municipal districts in the province have accumulated surpluses totalling $9.5 billion, about half as large as Alberta’s $18.1-billion Heritage Fund, which was established by former premier Peter Lougheed as the province’s long-term savings plan.

By contrast, the richest county in the province’s southeast, Cypress County, has an accumulated surplus of $244 million, only good enough for the 18th-highest reserves in the province.

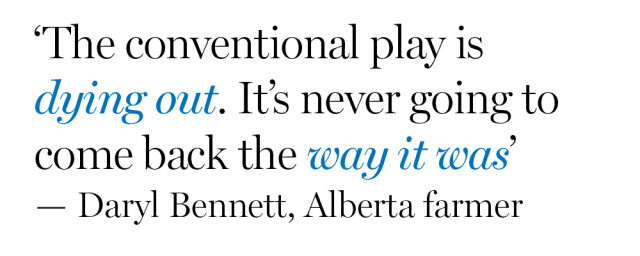

“The conventional play is dying out. It’s never going to come back the way it was,” Bennett said, adding that landowners in the south are looking at ways to repurpose the unremediated land left behind by bankrupt oil and gas companies because they no longer believe the wells in those areas will be bought by new operators.

Cypress County is home to older natural gas infrastructure around Medicine Hat, but areas in the south, which are no longer beehives of oil and gas activity, have average cash reserves of $143 million.

Some counties in the area have watched multiple bankrupt oil and gas companies such as Trident Exploration Corp. and Houston Oil & Gas Ltd. hand responsibility for cleaning up their aging wells to the Orphan Well Association, an independent non‐profit organization under the Alberta Energy Regulator.

“What it does create now more than anything is a situation where some have and some don’t have. We’re going to have to work with the provincial government on the distribution of the (municipalities grant) that we have from the province,” Kemmere said.

Proposal sees abandoned oil wells going solar

By Barb Glen

Published: November 21, 2019

The Western Producer

The plan started as a small pilot project in Alberta but has caught the attention of the provincial energy regulator

A plan is taking shape to erect small solar installations on the sites of Alberta’s abandoned oil and gas wells.

If successful, it could prove to be a classic case of making a silk purse from a sow’s ear, since myriad oil and gas company bankruptcies have resulted in the abandonment of thousands of wells, inundating the Orphan Well Association that has a mandate to seal the wells and reclaim the sites. Losses in the energy industry have also reduced municipal tax revenue and reduced or eliminated lease payments to landowners.

RenuWell, a project spearheaded by former Taber, Alta., area resident Keith Hirsche, is the entity behind a pilot project within the Municipal District of Taber. Hirsche, who has a background in oil and gas industry research, initially planned to start small but the idea has gained the attention of regulators and interest is building.

“We went to the M.D. of Taber with the idea of getting a development approval for (one) site and what it’s turned into is this policy piece funded by the MCCAC (Municipal Climate Change Action Centre) to kind of set the framework for doing this on a larger scale,” said Hirsche.

Now the Alberta Energy Regulator (AER) is interested in seeing solar installations at 100 to 200 sites per year, he said.

“I think once we get the first ones on the ground, a lot of that kind of prep work for the policy side has already been done and would facilitate that kind of expansion.”

RenuWell has held a number of meetings with landowners about the idea, and has found willing listeners among farmers and ranchers who have oil and gas sites on their land but who no longer receive lease payments from troubled or bankrupt energy companies.

Existing lease sites already have road and electrical access so that investment has already been made. The technical side of putting up small ground-mount solar arrays of 500 to 700 kilowatts is fairly simple, Hirsche said.

“We can basically go in and do a number of these small sites in a very repeatable fashion and we can reach similar costs to what the large scale utility projects can achieve. At least that’s what the business model says.”

Daryl Bennett, a farmer and member of the Action Surface Rights group, is involved in the project and has helped RenuWell in its contacts with landowners.

He lists some of its advantages as:

- reducing Orphan Well Association inventory

- reducing industry reclamation costs

- reducing Surface Rights Board payments on behalf of the province

- helping stabilize municipal tax revenues

- reducing landowner electrical costs

- stabilizing electrical grid

- reducing need for large transmission lines

“A lot of these farmers want to keep getting the revenue (from lease payments.) We can just come in and put in these small solar panels. It stabilizes the grid. It doesn’t take new farmland out of production. It doesn’t require new transmission lines going across other people’s land. And it does pay some taxes to the county. So it’s a good news story for everybody,” said Bennett.

“It looks like it could easily go ahead and we’re talking hundreds of sites, maybe thousands.”

RenuWell is exploring various ownership options for the sites. Landowners may want to purchase and use the systems for their own power and irrigation needs. Co-operatives among farmers could be formed for larger agricultural electrical needs. Municipal or corporate ownership are two other options.

As well, “there’s a big solar developer that is interested in using us as kind of a new development model, rather than taking land that’s useful for agriculture for that purpose,” Hirsche said.

In a report written for the M.D. of Taber newsletter, RenuWell said its project addresses landowner concerns about large solar installations.

“A common concern was raised about maintaining the agricultural land base in the face of large utility-scale solar projects. This concern has been largely relieved due to our preference to re-use existing leases, which are located in lower productivity areas like pivot corners or tame grassland,” the report stated.

A major hurdle in the early stages was how to manage lease transfer, Hirsche said.

“The AER was really concerned that this would turn into another way of oil companies dumping liabilities, so it was a lot of work to kind of put the safety mechanism around that to reduce that risk.”

Getting a policy in place has smoothed the way for the pilot project and potentially larger solar conversions of sites. Hirsche said construction on the first site is expected to begin in early 2020, with electrical generation starting about three months later.

Ron Huvenaars, a farmer and chair of Action Surface Rights, said the RenuWell proposal is interesting.

“There’s a lot of potential there,” he said. “It seems like it should be a win–win but the first one has to get done. It’s always a little scary when you’re using numbers provided by somebody. … It’s like a lot of things. You’ve got to get the first one done and see how it goes.”

Bad weather cancels sugar beet harvest in southern Alberta

Michael Franklin, Senior Digital Producer

Published Friday, November 8, 2019 1:59PM MST

Last Updated Friday, November 8, 2019 5:39PM MST

LETHBRIDGE – After a long, cold and wet summer, southern Alberta farmers won’t be able to harvest their damaged crops after Canada’s largest sugar company said it doesn’t have the capacity to process it.

Rogers Sugar Inc. announced Thursday, following an analysis in partnership with the Alberta Sugar Beet Growers, that it would not be harvesting any more sugar beets due to “severe snow and frost damage.”

As a result, only about 60,000 to 70,000 metric tonnes of refined sugar is expected to come from this year’s crop.

Sugar beets are grown by over 200 families in the southern Alberta region and supplies between eight and nine per cent of Canada’s sugar.

According to CTV Lethbridge weather special Dory Rossiter, ‘snowmaggedon’ in September dropped over 60 cm of snow in the region.

“In the far south of the province, we experienced only four days above 30 degrees during June, July and August. We also had 27 days of below average temperatures and 89 mm of rain, in total, during those same months.”

It’s believed only 55 per cent of the sugar beet crop was harvested before the company called off operations.

Rogers says it is looking at a number of options to provide sugar to its customers, including relying heavily on an excess supply of cane sugar from refineries in Vancouver and Montreal.

Farmers lose — and weeds win — when energy companies walk away

When well sites are abandoned, the rent cheques often stop while the noxious weeds flourish

By Jeff Melchior

Published: October 9, 2019

Alberta Farmer Express

“Kochia six feet tall and completely covering the whole leases. We have many that look like this. When I phone, no one even answers the phones.”

This tweet from Lethbridge-area farmer Kevin Serfas in August likely could have been written by any one of hundreds of Alberta producers with abandoned well sites on their farms.

At last count, there were 150,000 energy leases in the province considered “orphaned” or inactive with no solid plans to reclaim them — some abandoned decades ago.

And those numbers from the Orphan Well Association inventory are on the low side, said Daryl Bennett, a farmer and director with the Alberta Surface Rights Federation.

“There are far more orphans than there are in the Orphan Well Association inventory and there’s a lot more coming,” said Bennett, citing Trident Exploration (a Calgary-based junior oil and gas company which ceased operation in May) as an example.

“Trident alone has 4,600 wells that haven’t hit the orphan well inventory yet.”

That leaves farmers such as Serfas not only dealing with unpaid rent but also having to figure out what to do with weeds. Kochia is a particularly bad one — not only a prolific seed producer but adept at developing herbicide resistance.

And even though he’s one of the biggest farm operators in the province (he and his family farm more than 50,000 acres), attempting to cut the kochia himself would be a logistical nightmare.

“I could manage them but with 50 or 60 leases on my property I would have to hire a full-time guy,” Serfas said.

The option of doing the work and billing the companies for the expense isn’t realistic either. Several unsuccessful attempts to reach some of the companies by phone and email have led him to wonder if they even still exist.

Nevertheless, several dry years in a row in southern Alberta have forged the perfect breeding conditions for kochia, which produces tumbleweeds that can spread its seeds far and wide. For producers with infected leases, it will likely fall on them to cut and spray it.

Kochia is difficult to manage and spreads quickly but has to be dealt with, said Charles Geddes, an Agriculture Canada researcher in Lethbridge.

“Everybody should take responsibility for (kochia),” he said. “If the plant is growing into the fall and has that tumbleweed structure, it should be cut off to stop it from tumbling away, which contributes to the expansion of this problem from field to field.”

A worsening situation

Aside from maintenance, the big question on the minds of many producers with abandoned wells on their properties is, “How am I going to be compensated?”

In January, the Supreme Court of Canada ruled in a landmark case dealing with failed oil and gas company Redwater Energy that bankrupt or insolvent energy companies must fulfil their environmental obligations before paying back creditors, including landowners.

But reclamation takes money, and lenders are not in a rush to come to the rescue of bankrupt companies, said Bennett. And the ruling has compounded the problems for ones struggling to survive, he added.

“It’s definitely made it harder for the smaller companies especially to get financing,” he said. “A lot of these companies are the ones neglecting to do proper weed control and maintain things.

“I talked to the vice-president of one company and he just said, ‘Look, we just don’t have the money.’”

Many companies are in that position, he added.

“It paints a pretty grim picture but that’s not the farmer’s issue. Farmers are entitled to have those leases taken care of in a timely manner and to receive their annual compensation.”

So what can producers do? Not much, said Bennett.

They can write to the Alberta Surface Rights Board and ask for help getting unpaid rent money for leases, but they will likely have to be patient.

“The surface rights board is at a crisis point,” he said. “It has a huge backlog, it doesn’t have enough staff and it probably has a limited budget. In some cases you can expect two years to have your annual compensation paid to you.”

As for getting companies to come out and cut kochia and other weeds, don’t hold your breath. “You can’t force anybody to take care of the weeds. The Orphan Well Association generally does not take care of weeds.”

High-maintenance weed

Southern Alberta continues to battle a growing population of kochia, having faced its third consecutive year of the dry conditions in which the tumbleweed thrives, said Geddes.

Kochia is usually managed throughout the growing season. However, Geddes said there are still things producers can do to manage it post-harvest and pre-seeding. For example, farmers who harvested around patches of kochia need to cut those patches as soon as possible.

“Our recent research is beginning to show that kochia seed becomes viable throughout or closer to the end of August. After that you start to see more and more viable seed on the plant, so the earlier you can get in there, the earlier you can cut the plant off and limit the production of viable seed.”

Cutting may not be enough, however.

Kochia is quite resilient and can regrow after harvest under the right environmental conditions, said Geddes. A post-harvest burn-down may be necessary. However, kochia is notoriously herbicide evasive and some populations are resistant to Groups 2, 4 and 9 herbicides.

“Once we see resistance in the Group 4s, that starts to drastically limit the options we have for effective herbicides in small-grain cereal crops like spring wheat,” he said. “But we still need to determine whether Group 4 resistance in kochia covers a single or multiple active ingredients within this site of action.”

There are chemical options available to manage triple-resistant populations. Geddes cites Infinity — a Group 6 and Group 27 combination herbicide — as one example.

The difficulty with Infinity and several other kochia-effective herbicides is they can leave behind residue in the soil, possibly limiting crop options in the following year. This is where longer-term thinking comes in.

“Planning out your rotation in advance can really help you get ahead of these kochia populations,” he said. “You can use these more effective herbicides if you plan to seed a crop next year that is not as sensitive to the residual impact of the herbicide.”

However, chemical solutions are just one part of an overall kochia-killing strategy, said Geddes. Crop competition is another.

“The weak point of the life cycle of kochia is that the seed has very little dormancy and persists only one or two years in the soil seed bank. Planning out your rotation to plant two competitive crops in a row could go a long way towards limiting seed production and eliminating that population.”

Another management practice is to plant winter wheat to compete with kochia. There’s not a lot of research data available in this specific area, said Geddes, but it’s something that “just makes sense.”

“If you seed a winter crop you have an established crop in the spring while kochia is trying to emerge.”

Landowners’ rights in danger of being eroded, says advocate

Energy association wants review process streamlined, which could limit the ability to raise concerns

By Jeff Melchior

Published: October 9, 2019

Alberta Farmer Express

A growing number of abandoned energy leases in Alberta might make farmers wonder if it’s worth allowing an energy company to come onto their land in the first place.

However, a “pro-oil and gas regulatory environment” may make it more difficult to express concern over proposed energy projects, says Daryl Bennett, a director with the Alberta Surface Rights Federation.

According to a document provided by Bennett, the Canadian Association of Petroleum Producers has been lobbying the Alberta Energy Regulator (AER) to “expedite” energy project approvals whenever possible. The association specifically suggests that the energy regulator be given increased authority to decide which projects are worthy of the full 30-day review window in which the public can voice concerns.

If such “streamlining” was to take place, it could partially or completely bypass landowner and public input, said Bennett.

“Today, when industry wants to come on your land, you can file a statement of concern to the AER and then ask it to address your concerns,” he said. “But industry and government are now looking like they are trying to restrict that play.

“I think last year there were probably 400 statements of concern filed and I think it only resulted in 14 or 15 hearings.”

Bennett said he is also concerned that the provincial government’s environmental policies will give energy companies carte blanche to ignore or minimize their maintenance and reclamation responsibilities.

“Once again it’s the old Conservative party attitude that industry is far more important than the environment,” he said.

Bennett emphasized that he’s not talking about the environment in a “tree hugger” sense but rather landowners’ rights to enjoy their property without being left with a mess.

“Landowners are getting very upset,” he said. “The groups representing landowners and their legal counsel are surprised what this new government is doing. We are very concerned that property rights are going to be trampled so industry can get on doing what it’s always done and create a bigger mess.”

Alberta Energy Regulator’s former CEO grossly mismanaged public funds to create international centre: auditor

Former CEO displayed ‘reckless and wilful disregard’ for the proper management of public funds, report says.

Tony Seskus · CBC News · Posted: Oct 04, 2019 1:03 PM ET | Last Updated: October 4

Jim Ellis, shown in an old promotional photo, grossly mismanaged public funds while president of the Alberta Energy Regulator and the now-defunct International Centre for Regulatory Excellence, according to the Office of the Public Interest Commissioner. (Alberta Energy Regulator)

Alberta’s energy regulator wrongfully used its resources to establish an international centre outside its mandate, while its former CEO displayed “reckless and wilful disregard” for the proper management of public funds, according to investigations by three different provincial government watchdogs.

The damning reports by Alberta’s auditor general, public interest commissioner and ethics commissioner centred on the creation and operation of the now-defunct International Centre for Regulatory Excellence, or ICORE.

The Alberta Energy Regulator (AER), which is funded by a levy charged to the energy sector, oversees the province’s massive energy sector and is expected to ensure the safe and environmentally responsible development of the industry.

It established ICORE in 2017 as a separate, external entity that would offer training to regulators around the world.

In findings released Friday, both the auditor general and public interest commissioner found this was outside the AER’s mandate and that public money was spent inappropriately on ICORE activities.

Alberta Ethics Commissioner Marguerite Trussler, left, Public Interest Commissioner Marianne Ryan and Auditor General Doug Wylie, shown at a Friday news conference in Edmonton, shared findings from their respective independent investigations into the activities related to the AER and ICORE. All found the Alberta Energy Regulator wrongfully used its own resources to establish an international centre outside its mandate. (Jason Franson/The Canadian Press)

“AER engaged in activities outside of its mandate and public money was spent inappropriately on ICORE activities,” read the report from Alberta Auditor General Doug Wylie.

He estimated the total financial impact of ICORE activities on the AER totalled $5.4 million, though $3.1 million was recouped. The AER is still out of pocket $2.3 million, according to the audit.

Wylie also concluded that ICORE activities lacked a credible benefit to the AER.

‘Gross mismanagement’ by former CEO

The Office of the Public Interest Commissioner report levelled some of its strongest criticism at Jim Ellis, who was president and CEO of the AER and president of ICORE.

“His actions demonstrated a reckless and wilful disregard for the proper management of public funds, public assets and the delivery of a public service, which … constitutes gross mismanagement,” the report said.

Ethics Commissioner Marguerite Trussler’s report also found that Ellis had a conflict of interest “in that he furthered his own interest and improperly furthered the private interest of three other employees.”

“The primary motivation behind ICORE not-for-profit was to provide future employment for Mr. Ellis and others.”

However, Public Interest Commissioner Marianne Ryan told reporters during a news conference that there was no evidence to suggest Ellis benefited personally from a financial perspective.

The matters did not reach the threshold to refer them to the solicitor general for potential criminal charges, she said.

Ryan added that her report is not a condemnation of the AER as a whole. “It was employees of the AER that brought this matter to my attention and assisted with the investigation,” she said.

Controls to monitor expenses at first ‘non-existent’

The auditor general’s report also found that controls and processes to protect against potential conflicts of interest failed and that oversight from the AER’s board was ineffective.

Alberta Auditor General Doug Wylie’s report also found that controls and processes to protect against potential conflicts of interest failed and that oversight from the AER’s board was ineffective. (CBC)

“Controls to track and monitor expenses related to ICORE activities were at first non-existent and then poorly implemented,” the report states. “The tone at the top at AER did not support a strong control environment or compliance with policies.”

Wylie’s report said a “culture of fear” at the AER stifled concerns regarding ICORE activities, with a number of staff interviewed by his office saying that employees who expressed complaints felt at risk of losing their jobs.

The culture at the AER stifled concerns regarding ICORE activities, Wylie said. A number of staff interviewed by his office used the phrase a “culture of fear” and said employees who were vocal about expressing complaints were at risk of losing their jobs.

AER sued ICORE in 2019

A recent CBC News investigation found a close and complicated relationship between the AER and ICORE, including the involvement of Ellis.

Several key figures who were involved with ICORE, including Ellis, are no longer associated with either organization. Ellis resigned from his post at the beginning of 2019. Ellis could not immediately be reached for comment Friday.

Also earlier this year, the AER sued ICORE and received a default judgment in its favour for $2.6 million for money it said it was owed for the development and delivery of training materials.

Alberta Energy Regulator CEO Jim Ellis to resign in January

The results of the provincial investigations come at a time when the energy regulator is under scrutiny from the provincial government.

In September, Energy Minister Sonya Savage announced her department was launching a review of the AER and appointed an interim board of directors to set its future direction.

Savage and Environment Minister Jason Nixon issued a joint statement Friday on the results of the investigations, saying they “cannot condemn the practices noted in these reports strongly enough.”

“Our government was elected on a promise to reform the AER, which is precisely why we have already taken action, launching a review of the AER in August and replaced the board in the same month,” the statement said.

The recommendations contained within these reports will inform the Alberta government’s review of the AER, they said, noting that they expect the agency’s interim board to implement the reports’ recommendations.

Among the recommendations outlined in the three reports:

Corporate governance throughout Alberta agencies, boards and commissions needs to be strengthened.

AER staff need to be made aware of and sufficiently trained on the whistleblowing process.

The AER should evaluate whether any additional funds expended on ICORE activities are recoverable.

In statement, the interim board of the AER said it will take the recommendations seriously and implement any required actions “in order to enhance public confidence” in the regulator.

“While ICORE was originally established to provide training to AER employees and support information-sharing across jurisdictions, it is clear now that a small group of senior leaders used AER resources in a way that is unacceptable,” the regulator said in a statement. “These individuals are no longer employed at the AER.”

AER overhaul a dangerous game

By Lethbridge Herald Opinion

September 11, 2019

Grant Sprague and Bev Yee, Alberta deputy ministers of energy and environment respectively, are very capable senior bureaucrats. Here’s hoping they bring to bear all their skills for the review of the Alberta Energy Regulator.

They should keep in mind that the review ought not to be the witch hunt the current political framing suggests it is.

Increasingly, investors look to ensure they capitalize on energy companies that take seriously those considerations related to environment, social and governance.

That should serve as a reminder not to toss out the baby with the bathwater as the United Conservative Party seeks to erase anything vaguely associated with the thinking of the previous NDP government.

Alberta energy politics are becoming hateful and divisive. And instead of constructively and collectively understanding the complex restructuring with which it must grapple, the industry has become fractious and fragmented. So we find answers to complex issues are distilled down to naively simplistic solutions.

There are elements of the sector that simply adore a bogeyman. There’s plenty to be had if you subscribe to the UCP thesis that everything wrong in energy is someone else’s fault.

The Alberta Energy Regulator (AER) is merely the latest culprit the UCP is handing to those in the sector looking for something to hang in effigy.

Want a scapegoat for energy sector travails? The UCP has a closet full ready to trot out: other provinces, other Canadians, foreign interests, liberal politicians.

One key driving force behind the review, suggests Alberta Energy Minister Sonya Savage, is the time it takes to process an application. She points to other jurisdictions like Texas, which she argues processes things exponentially faster.

Implicit in her argument is that this is attractive to investors. To a point it may be, but the minister’s advisers would do well to get in front of her the other side of the Texas story: about investment leaving in droves and about looming environmental debacles, particularly involving water.

One thing increasingly binds investors together: an expectation that companies with which they place capital understand and respond to environment, social and governance imperatives. And they expect solid and robust regulatory frameworks within which firms operate in order to safeguard their capital.

AER is a world-class regulator. In recent times, it has introduced a broad spectrum of improved services designed precisely to solve the very problems of which it has been accused. It has been tackling red-tape challenges for years.

Two recent innovations come to mind: the OneStop process that simplifies applications dramatically and the Integrated Decision Approach, which reflects a long-range understanding of an application.

Regulatory dynamics are a two-way street. Many companies that have hacked staffing in recent years need to assess the quality of their regulatory requests. Remember: garbage in, garbage out.

Good regulators are creatures of the sector and society. So AER ought to mirror regulatory and socio-economic realities.

Has the AER’s staffing grown in recent years?

It has changed, largely in response to the increasingly complex environment in which it’s expected to function – an environment that bears little resemblance to even 15 years ago. For example, when AER was created, it took on the Environmental and Sustainable Resource Development Department functions. Yet its staffing has remained relatively flat for the last several years.

The UCP is desperate to appease certain elements of the industry. But destroying AER’s ability to balance environmental and fiscal imperatives could actually set Alberta’s recovery back dramatically.

Weaken the regulatory framework at your peril. Sloppy regulation begets sloppy industrial operation. And sloppy industrial operation begets sloppy reputation and social unrest. And the kind of capital you want driving the sector loathes sloppy reputations and the risk it brings.

For Sprague and Yee, and the interim board, this will be a delicate task. Deputy ministers must be, of course, political creatures to be effective in their roles. Here’s hoping they help their political masters guide a reasonable and rational review that keeps front and centre a regulator’s role in a robust economy.

And here’s hoping the UCP resists its political impulse to toss people and process under the nearest conveniently rolling bus.

Perhaps most important will be the stakeholder input. It ought to guide the review to stay away from the UCP temptation to bring the AER closer to political will.

Remember the great line from the Joni Mitchell song Big Yellow Taxi: “You don’t know what you got ’til it’s gone.”

Bill Whitelaw is president and CEO at JuneWarren-Nickle’s Energy Group and former publisher of The Lethbridge Herald. Distributed by Troy Media.